How much does it cost to own a home in Winnipeg?

Aside from the mortgage payment, how much does it actually cost to own a home in Winnipeg? What are all the costs involved in buying a home?

The cost most frequently associated with home ownership is the monthly mortgage payment, which depends heavily on the current interest rates charged by mortgage lenders. However there are many hidden costs to owning and maintaining a home, which many new homeowners may not be aware of.

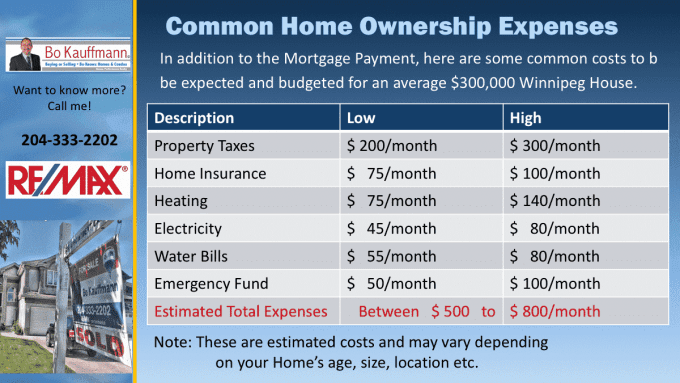

These costs are rough estimates and an average cost and will vary, depending on the size and construction quality of the home. Heating bills, especially, can vary widely. Water bills are affected by the size of the property (how much lawn will you be watering in July?)

Electricity mostly depends on the size of the household. How many computers, TV’s and bedroom lights will be on every evening? And homeowners insurance depends on many factors, such as age of the home, size and value of the home and even the neighbourhood.

Maintenance costs vary and are closely associated to the age of your home. Older homes will require more upkeep and system replacement (example: HVAC system, roof, windows, plumbing systems and other major systems will need to be upgraded over time). So lets take a look at the monthly cost of being a homeowner.

Cost to own a home

Property Tax

Depending on your area, value of your home and surrounding home prices, lot size and about 20 other factors, Property Taxes in Winnipeg can vary from about $1500 a year to tens of thousands a year. This is considered one of the major home owning costs.

Your ‘average’ home owner however should budget for between $200 and $300 per month. That latter would cover a home with a GROSS property tax of $4,300 a year, (minus the current Homeowners Tax Assistance of $350)

Homeowner Insurance (Property Insurance)

In a house, the owner needs to protect the entire building (and any outbuildings) from a variety of perils. Again depending on the home value the insurance will vary, but as a general point of reference, it’s a good idea budget between $75 and $100 per month for home insurance.. In a high-rise condo, this will be significantly lower cost.

It should be noted that insurance companies often look at the replacement cost, rather than the actual cost of the home. As an example, the home’s purchase price might have been $350,000, but your homeowner’s insurance company determines that it would cost $420,000 for a home builder to replace it.

This of course depends on current construction costs. As a general rule, it is a good idea to go with the higher insured value.

If you instead to insure your own home for just the sale price, you will only be covered for a percentage of your overall loss.

Heating & Electricity Monthly Cost

First day when you move into your new home, read all the meters

Combined, the owner should budget for between $120 to $220 a month, approximately. Much depends on the size of the home and family, as well as the quality of the home’s insulation.

Another important factor is the method by which your house is heated: In many areas, electric heat is much more expensive than gas. This will have a major impact on your monthly payment amount.

Water & Sewer

On average, you should expect bet. $50-$80 per month, again depending on usage. Have a large pie-lot that needs watering? Got 3 teenage boys that take lots of hot showers? Or are you an empty nester with very few watering needs?

All these things affect your water bill as a home owner. This is another category which is normally covered by the condo fees, so condo owners already pay for this service.

Home Ownership Emergency Fund

Unless your home is brand new and everything is still under warranty, a home owner is well advised to set aside a small emergency fund. In a condo, this is usually included and called a ‘Reserve Fund’.

If you are buying a house, this should be calculated as one of the potential costs. How much money should an owner set aside> A good rule of thumb is to set aside 5 cents per square foot of your home. So a house which is 1,200 square feet would dictate a monthly deposit into a savings account of $60.00.

Alternatively, you could tie the amount to your gross income, for example a percentage of your bi-weekly pay-check. No matter how you calculate your contributions, putting money aside for unexpected repair costs will help you avoid headaches in the long run.

What other cost to own a home are there?

Furniture and appliances, lawn care, life insurance and other ongoing costs should be on your budget lists. These are costs your real estate agent might not have an opportunity to discuss with you. But especially first-time buyers are well advised to keep these in mind.

I hope that this does not discourage you from a home purchase, as there are many benefits to home ownership that far outweigh the costs.

Also, if you’re looking to buy your first home, don’t forget that condominiums offer a great opportunity to get into the real estate market. There are many reasons why a condo might be right for you. The condo fees are an often maligned and mis-understood issue.

The fact is that condo fees often replace, or reduce, some of the usual home owner costs listed above. Condo fees are not as scary or wasteful as you might have heard.

Also check: Closing Costs when buying a house or condo in Winnipeg

Home Ownership F.A.Q.’s

Q: How much does it cost to buy a house?

A: The cost to buy a house can vary depending on factors such as location, market conditions, and the size and type of the house. It is important to consider not only the sale price of the house but also other costs associated with the purchase, such as closing costs, home inspection fees, and mortgage insurance.

Q: What are the closing costs involved in being an owner?

A: Closing costs are additional fees that are required to be paid when finalizing the purchase of a home. These costs can include fees for title insurance, attorney fees, appraisal fees, and loan origination fees, among others. It is important to factor in these costs when budgeting for the purchase of a home.

Q: How much is the average monthly mortgage payment?

A: The average monthly mortgage payment depends on factors such as the purchase price of the home, the interest rate on the mortgage, and the length of the mortgage term. It is recommended to use a mortgage calculator or consult with a mortgage lender to get an estimate of the monthly mortgage payment for your specific situation.

Q: What are the ongoing costs of home ownership?

A: The ongoing costs associated with owning a home include mortgage payments, property taxes, homeowner’s insurance, and utility bills (such as water, electricity, and gas). Additionally, there may be costs for home maintenance and repairs, as well as fees for a homeowner’s association (if applicable).

Q: What is mortgage insurance and how much does it cost?

A: Mortgage insurance is an additional insurance policy that is required for home buyers who have a down payment of less than 20% of the purchase price. The cost of mortgage insurance can vary depending on factors such as the loan amount and the borrower’s credit score. It is best to consult with a mortgage lender to get an accurate estimate of the cost of mortgage insurance for your specific situation.

Q: Do ongoing expenses of owning a house include lawn care?

A: Yes, ongoing expenses of owning a house typically include lawn care. This can include expenses for mowing, landscaping, and general maintenance of the yard. It is important to budget for these ongoing expenses when considering the true cost of homeownership.

Q: What are the benefits of ownership?

A: Owning a home can provide several benefits, such as building equity in your home over time, the ability to customize and personalize your living space, and the potential for long-term financial stability. Additionally, owning a home can provide a sense of pride and belonging in a community.

Q: How much does it cost to maintain a home?

A: The cost to maintain a home can vary depending on factors such as the age and condition of the home, the size of the property, and the location. It is important to budget for ongoing maintenance and repair costs, which can include expenses for plumbing, electrical work, HVAC system maintenance, and general upkeep of the home.

Q: What is the true cost of home ownership?

A: The true cost of home ownership goes beyond the purchase price of the home. It includes not only mortgage payments but also ongoing costs such as property taxes, homeowner’s insurance, utility bills, and maintenance and repair expenses. It is important to consider all of these costs when deciding whether to purchase a home.

Q: Is private mortgage insurance required to buy a house?

A: Private mortgage insurance (PMI) is typically required for home buyers who have a down payment of less than 20% of the purchase price. PMI is an additional cost that provides protection to the lender in case the borrower defaults on the mortgage. The cost of PMI can vary depending on factors such as the loan amount and the borrower’s credit score.

Listen to this post

Also check: Closing Costs when buying a house or condo in Winnipeg

About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

Sanders&Johnson

To reduce your spending on heating ang cooling home, consider installing a smart thermostat. For every degree you turn down your thermostat this winter, you’ll use up to 3 percent less heating energy. However, please don’t overdo it. If you live in an area with extremely cold temperatures, too low temperatures in your home may cause pipes to freeze.

Portella

Thanks for sharing this! To improve home insulation and increase home’s energy efficiency, consider caulking window trim and using weatherstripping to reduce air leaks. If windows in your home are old, think about replacing them with energy-efficient units. After all, air leaks from bad quality windows can account for 30 percent of your home’s energy bill.

In areas with extreme temperatures in winter and summer, weather resistant windows can be an excellent solution.

Happy Hiller

You can drastically lower your spending by improving your home’s energy efficiency. Here are lots of ways to do this: https://happyhiller.com/tips-tricks/tips-save-money-utility-bills/. Please remember that using less energy is not about discomfort. It’s rather about conscious consumption..

Bruno Henrique Barbosa

Thanks for the info.. I’ll pass this along to my sister who is looking for a house.

Cärlös Mödrïć

Some of these costs are included in condo fees. Thats why I bought a condo. But great article.

Gabriel Ferreira

Absolutely agree….. owning a home is better than renting

AugustOo Khalifa

Thank you….. even with these costs, owning the home is the best

Briele Santos

Very helpful. I appreciate knowing the true cost of home ownership.

Devin Windeatt

Robyn Kastner

Maureen Sy

Marven Fernandez Avaricio

Paul Czarwin Copio

Wala NA Orig Apple Catacutan Sy-Copio

Nantale Madison

Ehimen Williams