How much Mortgage can you afford on your income?

Most buyers realize that, before going shopping for a new home, they need to be pre-approved by a reputable lender. Whether a bank, credit union or mortgage broker, the financial lender should do a proper credit check and offer the prospective buyer a “Pre-Approval Letter”, showing the fact they are pre-approved, and possibly even stating the maximum dollar-value of the mortgage.

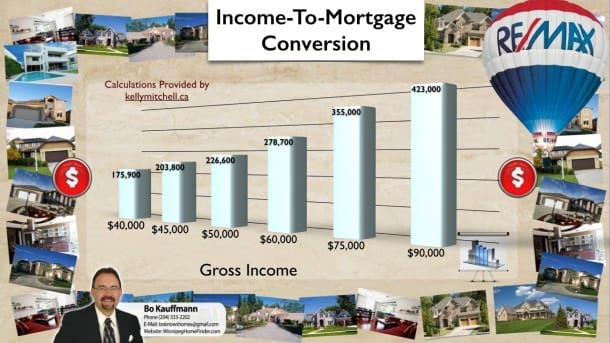

But for those buyers who are simply curious as to what type and size of home they can afford on their current income, we assembled this little sample list with the help of Kelly Mitchell of Invis Mortgage Brokers.

In her calculations, Kelly assumed a credit rate of 3.10% (NOTE: This is an assumption for this example only. LOWER rates MAY be available, depending on your credit rating and other factors)

Other assumptions include an average heating bill of $100 per month, and net taxes ranging from $1,500 to $3,300 a year, gradually increasing along with the income levels. IE: Lower income is assuming a lower-priced house, while the high income is assuming a higher priced property). All calculations are based on a 25-yrs amortization.

Quick-Poll

[socialpoll id=”2153093″ type=”set”]

Approximate Ratios

You can see in the graph below that a gross annual income of $40,000 might qualify the buyer for$175,900 mortgage, while a $90,000 income may qualify the buyer for a $423,000 mortgage.

NOTE: PLEASE DONT RUSH OUT AND BUY A HOUSE OR CONDO BASED ON THIS GRAPH….. INSTEAD, OBTAIN A PROPER PRE-APPROVAL FIRST!

Here is your down-loadable PDF version: IncometoMortgageConversion

Keep in mind, please, that buying a home is probably the biggest and financially most important step you'll take. Buying real estate should be a team effort, where the buyer utilizes the services of a number of professionals. If and when you are ready, begin by contacting a real estate agent , who can then recommend many of the other services you will need.

About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

Winnipeg Home Finder

The chart is simply an overall quick-referrence showing the MAXIMUM a bank might lend someone, based on the various income levels. If you click thru to the actual article, which explains the interest rates used, it also cautions to do further investigation before buying a home. Just like you would never (I hope) buy a car off a magazine ad, no one should use this chart to just go out and buy a house. And yes, interest rates may very well go up next year, as they had been threatening to do in the past few years.

Nick Katiniaris

The chart is misleading! The third axes I was referring to was the interest rate, which from what I can see everyone thinks will never go up because apparently the banks hate making money and have no bond holders to answer to!! The bank of Canada has already said home prices are overvalued!

Sandra Epp

I think it promotes house poverty… Sometimes I struggle at my current ratio, and yet it recommends a mortgage almost 30k higher?

Winnipeg Home Finder

Not "recommends"…. These are the upper limits , and it is up to the buyer to decide if they want to go that high. Banks are always willing to lend….but that doesn't mean its the right choice for the buyer

Fitri Damien Gagne

does not seem right

Winnipeg Home Finder

What do you feel is wrong?

Nick Katiniaris

Where's the third axes?!?!

Fred Carver on Faceb

Like it!