I think that you would agree that buying a house or buying a condo for the first time can be quite stressful and challenging. First time home buyers are surrounded by a large number of questions. This home buying guide offers some tips to first time home buyers, a home buyers guide to simplify their journey.

If you are looking to buy a home for the first time, perhaps you are busy thinking whether to hire a real estate agent or do the home hunting on your own. Budget and mortgage are other factors that may trouble you. You may be unaware of what extra expenses you may need to bear while purchasing a home.

If you prefer to watch the video, here it is:

6 steps to buying a house (or condo) in Winnipeg – A Home Buyers Guide

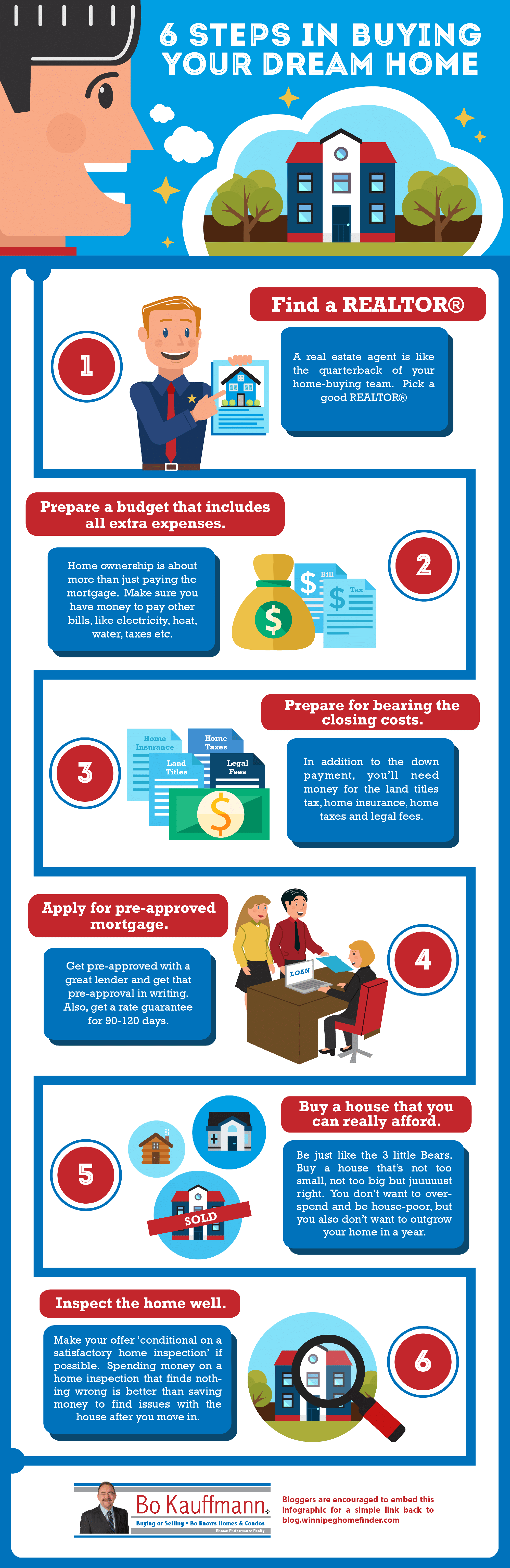

This is a recommended order in which home buyers should proceed. Old wisdom used to dictate that a buyer go and get pre-approved for a mortgage first. That is no longer the case. House and condo buyers are advised to follow these steps to buying a home:

- Prepare a Budget for their home expenses

- Save for their down payment and closing costs

- Select their real estate agent

- Get pre-approved by the right lender

- Shop for your perfect home

- Get a home inspection (if possible)

- The final steps in the home buying process

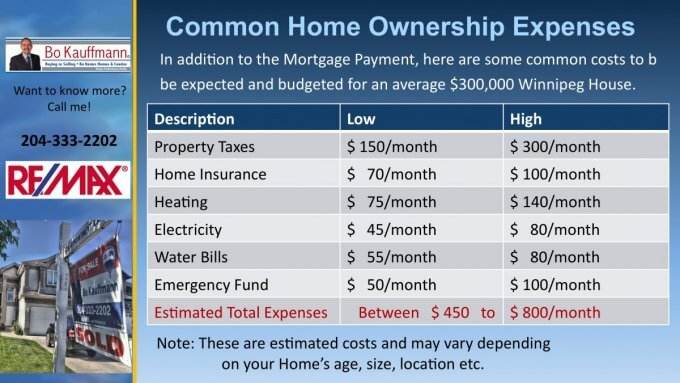

1) Prepare a budget that includes all extra expenses.

There are a number of extra costs involved in the ownership of a home, such as utility hookups, new appliances and moving. The moving costs always vary, with the average being $1,000. Utility costs for phone and electricity would range from $150 to $250. The survey costs, title insurance and appraisal fees should also be added to your budget. One helpful tool would be to use a Mortgage Calculator. Note: this step is especially important for the first-time home buyer.

2) Prepare for the down payment & closing costs.

A Real estate agent Burswood, advices buyers to keep aside almost 4% of the home price as the closing costs. One of the major closing costs is the land title transfer taxes. In Winnipeg, its generally accepted advice to set aside 2-2.5% of the price of the home for Closing Costs. In addition to the Land Titles Transfer Tax, closing costs would include things like legal fees, part of the property taxes (the part of the year when you own the home), and home insurance cost.

3) Find a REALTOR® before buying a house

A REALTOR® is far more aware of the real estate market of your locale than you. A skilled real estate agent can prove to be a great help during your house hunting. There are many reasons why a home buyer should be using their own real estate agent, including:

- Saving Time

- Saving Money

- Being fully represented in their transaction

- Convenience

for more reasons, read Reasons by home buyers should have their own agent.

HOW TO SELECT THE RIGHT REALTOR®

As mentioned above, your real estate agent is involved in nearly every part of the home-buying process. Therefore, selecting the right agent is of ultimate importance. Here are a couple of things you can do:

- ASK YOUR FAMILY AND FRIENDS FOR RECOMMENDATIONS

Chances are, someone close to you has just gone thru the process of buying a home in Winnipeg, and can give you feedback about their experience with their REALTOR®. If they had a great experience, get the name and consider him/her for the job.

- ONLINE REVIEWS AND RECOMMENDATIONS

Check the agents name on google, and also check to see if he/she is listed and accredited by the local Better Business Bureau.

Check out your agent when buying a home

Some basic tips

When you meet realtors, enquire about the experience of each and success rate. Make sure to hire one with whom you feel comfortable. Explain to your REALTOR about the aspects which hold priority for you, like schools, neighbourhoods and community groups.

Another option is to check your local BBB Reviews, to see if your prospective real estate agent is accredited by the Better Business Bureau.

4) Apply for pre-approved mortgage.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

Here is what NOT to do: Call a bunch of banks, credit unions and mortgage brokers, and say “Hi, whats YOUR best mortgage rate?” Why not?

Because it is a useless exercise! Mortgage lenders reserve their best rates for their best customers, and as they have no way of knowing if YOU fall into that category, they can not possibly give you an accurate rate over the phone.

Oh, they’ll quote you rates alright, but whether or not you actually qualify for that rate will depend on your credit rating, which requires a credit check.

Here is number 2 on the ‘Don’t Do This’ List: Don’t go to 4 lenders and ask them all to pre-qualify you. Why?

Each time a lender checks into your credit history, your rating actually takes a little negative hit!

Here is another reality: Most lenders are fairly competitive, and the actual difference between their rates quite often boils down to fractions of a percent. (Yes, over the life of the mortgage that CAN add up to thousands of dollars, but I’m here to suggest that there are other factors that may actually be of greater importance).

What could be more important than a few grand? Well, for one thing, the penalty a bank or lender charges when you try to get out of a mortgage early!

Watch those penalties

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Why would you close out early? Although you may not think so when you are buying the house, a lot can happen in a 5-year span (possibly the length of the lock-in mortgage). Maybe you get transferred with your company, or maybe there are cut-backs and you get laid off, having to sell your home. Or maybe marital separation, death or illness pop up.

Fact remains that a lot of unforeseen circumstances can come up within 5 years, and if you have to get out of a mortgage early, make sure it wont cost you an arm and a leg to do so.

5) The Home Buying Process

Perhaps one of the most important points in this home buyers guide is this:

You cannot enjoy your life, if the entire money you earn goes for the payment of your home. The minimum amount of down payment is usually 5%. Paying more as the down payment leads to a reduction in your costs. If the down payment is lesser, there is almost no equity left in your home.

If the down payment is lower than 20%, you may need mortgage loan insurance. This may result in extra costs and higher rates of interest. You certainly don’t want to be house-poor, but another common mistake is to purchase a house which is actually too small, forcing you to sell within a year or two as your family and needs grow. Here is a list of 7 of the biggest regrets home buyers have.

VIEWING THE HOMES

You’ll be receiving those new listings as soon as they are activated. Look thru them daily, and contact your agent when you are ready to view one (or several). Here are a couple of pointers:

GIVE YOUR AGENT A LITTLE NOTICE

In a perfect world, you will let him/her know that you’re ready to look at some properties at least one day in advance. Some of the homes may be occupied by renters, who, in Manitoba, have the right to be notified at least 24 hours in advance. So if you are ready to look at homes on a Saturday afternoon, for example, ideally you’ll let your agent know by Thursday evening

That way, he/she can begin the process of notifying the owners or tenants of these homes you want to see.

LIMIT THE NUMBER OF HOMES ON ANY ONE TOUR

Ideally, you’ll go out and see 4 to 5 homes. Any more than that, and they will blend in your mind. “Which was the house with the great kitchen?” or “Was that the one with the smokey smell”?

TAKE NOTES

6) Inspect the home well.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

Seek the help of a skilled home inspector, who would help you to detect any major damages. This would also safeguard you from paying additional costs on repair in future. This is a somewhat self-regulated industry, and nearly anyone with a flashlight and a ladder can call themselves a home-inspector. Be sure to back-ground check, or better yet: Call me for a referral!

Here is an interesting article about the best home warranty companies for your home.

Step 7) The Final Steps

LIFE INSURANCE OR MORTGAGE INSURANCE

Let me make this clear…. In this section we are talking about Life or Mortgage Insurance, NOT property insurance. The latter (property insurance) is necessary to insure the property in cases of fire, theft, vandalism etc,,,, and this type of insurance is mandatory if you are buying a home with a mortgage.

The reason is simple: Since the bank owns somewhere around 90% of your home (depending on the size of your down payment), the bank (or lender) needs to protect their investment.

However, Life Insurance or Mortgage Insurance is NOT mandatory, even though I have heard stories of some financial institutions trying to persuade their clients to buy mortgage insurance.

In my humble opinion, the buyer is usually better served by buying Life Insurance from a qualified life insurance provider/expert, instead of mortgage insurance. For a full description of each, see this article. Here is a summary of the differences between the two. (For a referral to a trusted Life Insurance Expert, contact me anytime)

PREPARING FOR POSSESSION

The time between when the offer is accepted and final, to the time when you take possession of your new home, you will have plenty of things to prepare. Assuming you’ve signed the mortgage agreement, here are the next things you have to do:

CONTACT YOUR LAWYER

Just let him/her know that the offer papers will be faxed to them by your real estate agent. Of course, let your REALTOR® know who your real estate lawyer of choice will be.

CONTACT A HOME INSURANCE COMPANY

Take the MLS listing information to your home insurance company. Quite often, the insurance company will have additional questions and will contact your real estate agent for answers. Another great reason to have your own agent when buying a home.

CONTACT A MOVING COMPANY

Depending on the season, you may need to hire the moving company several months in advance. Having an ‘odd’ possession date (something other than the 1st, 15th or last day of a month) can be to your advantage. Moving companies are usually less busy (and less expensive) on odd dates, such as the 12th of the month, for example.

CONTACT YOUR LANDLORD (IF YOU’RE CURRENTLY RENTING)

Make sure that you let your landlord know about your plans to move out. Actually, you need to check your lease agreement to make sure that you CAN get out early, without penalties. Other options might include the ability to sublet your apartment to a friend or relative, but discuss all of these options with your landlord.

Conclusion:

These are the major steps a home buyer should take to make the process of buying a house a success. A buyer should make an offer of purchasing a house with the advice of a professional real estate agent, preferably an Accredited Buyer Representative.

Also, it is very important for a buyer, especially a first time one, to keep emotions in check while negotiating with a home seller. Sellers may try to make the buyer buy in impulse, which can prove to be a wrong decision.

If you’re looking to buy a house or condo in Winnipeg in 2020, call or text Bo Kauffmann at 204-333-2202 or Email Him Here

F.A.Q. about Buying a House or Condo

Q: What is the best time of year to buy a home in Winnipeg?

A: The most popular time to buy is in the spring. That is because this is the time with the most available listings. The best deals can sometimes be obtained by purchasing in August & September, when buyer activity slows down.

Q: What is a better purchase option for a first time buyer: a house or a condo?

A: Condo ownership is a life style choice. It does not work for everyone, but is the right option for the right buyer. Do you travel? Work a lot? Or do you plan to have children soon? Pets? Love yardwork? Condos offer some things that houses can not….and vice versa.

Q: What is the minimum down payment for buying a house or condo?

A: Generally speaking, a buyer needs a minimum of 5%, plus approx. 3% for closing costs. I say ‘generall’ because sometimes lenders offer a ‘zero-down’ option. However, in such cases, the bank is loaning the 5% to the buyer, and the buyer will have to actually repay that 5% over the next 3-5 years.

Buying a house checklist

Other reading: Tips for first time home buyers from a mortgage broker.

Author’s Bio: Alisa Martin is a proficient guest blogger penning down articles on real estate. Her articles are highly informative and useful for the readers.

Please Follow Me On Social Media 💕

Want the latest news, tips and fun updates? Follow me on Pinterest, Instagram and ‘like’ my facebook page. Also follow me on Twitter, and connect on LinkedIn. I appreciate the show of support.❤️ About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

new house

Knowing what to check with your agent in buying a new house is very crucial. Thank you for sharing this informative article.

jackmendez154

Thank you very much for the tips, excellent article!

https://www.alveoland.com.ph/commtalk-online/premium-condominiums-in-makati/

Cassie Smith

The article is very good. It gives me a lot of information. It is very challenging when you are buying a new house. There are lot of things to consider. I’ve been checking out some new developments in our are and I encounter Paradise Developments. They have nice designed residential houses and I am thinking to contact some realtor to assist me with the process.

Ashley Collins

It was a good read! Buying a house is fun and exciting yet it’s a challenging journey. I’ve been checking out some new developments in our area and I’m crazy about these residential houses designed and are still being developed by Paradise Developments. Thinking about reaching out to a realtor to help with the entire process.

Bo Kauffmann

Thank you Ashley, I am glad you liked the post….

tayanders

Thanks for mentioning that buyers should set aside about 4 percent for closing costs. One of my friends is thinking of getting a home. These tips could help her budget for that, so thank you for sharing them. https://prichardrealestategroup.com/residential-listings

Filip

Looking for a new home is both exciting as well as scary, and I always welcome any tips and advice that I can get. Thanks, Bo, for all these great tips. I also think it is very important to properly inspect a house first, before buying it, specially if you are being offered a suspiciously low price on it. What do you think?

Kiffer Ward

Really appreciated this post. This is very helpful for the people that are looking to buy a condo or even house. Thanks for sharing your idea. I decided now to write an article about tips on how to spend your money when buying a condo.

บ้าน

The article is very good

Bo Kauffmann

Thank you very much…. is there anything in particular that you enjoyed?

Ligaya Alverne Tutanes

wow bibili na

MarcioWilges

Being in the moving and removals business, I can't even begin to tell you how many times we see first time homeowners who bite off more than they can chew when it comes to upgrading their homes. It's never an easy decision to buy something more expensive – people can get greedy. So think it's really important to do your sunms if you want to make sure that you end up with a house that you can keep for the long run!

home construction co

We're a group of volunteers and starting a new

scheme in our community. Your web site offered us with valuable info to

work on. You've done a formidable job and our entire community will be

thankful to you.

Gianne

Looking for a new home can be an exciting and challenging experience. Having a real estate professional that takes the time to understand your unique needs and lifestyle is important.

socialcelissia

RT @MelonieDodaro: 6 important steps to buying a house or condo https://t.co/83wRoi4SkJ via @bokauffmann

MelonieDodaro

6 important steps to buying a house or condo https://t.co/83wRoi4SkJ via @bokauffmann

wizardofwords

6 important steps to buying a house or condo https://t.co/sQM3lAFkhq via @bokauffmann

monctonrealtors

RT @KenDavidsonCA: 6 important steps to buying a house or condo https://t.co/fy9fHqJGfm via @bokauffmann

KenDavidsonCA

6 important steps to buying a house or condo https://t.co/fy9fHqJGfm via @bokauffmann

RBCJonChan

6 important steps to buying a house or condo – Winnipeg’s R.E. Blog

https://t.co/9IkLh0RwFj

bokauffmann

6 important steps to buying a house or condo

https://t.co/lFFfDs2Y5b https://t.co/XtZgBATjSR

kritterkondo

6 important steps to buying a house or condo https://t.co/QUfx6AEtte via @bokauffmann

KelvinLLee

RT @MortgageCapital: 6 important steps to buying a house or condo https://t.co/gi4iH7Bjhb via @bokauffmann

LoansCanada

6 important steps to buying a house or condo https://t.co/ggj8olINAk via @bokauffmann

bokauffmann

6 important steps to buying a house or condo https://t.co/x4AKOaAxe4

DrNotley

6 important steps to buying a house or condo https://t.co/4zgfs0M7z5 via @bokauffmann

reluctantreagt

6 important steps to buying a house or condo https://t.co/qOooGA2fr4 via @bokauffmann

NicoleBodwin

6 important steps to buying a house or condo https://t.co/QYDEqMXQQG via @bokauffmann

Chrisina_Loyd

6 important steps to buying a house or condo https://t.co/knnLD7WfrO via @bokauffmann

dollysekhon

6 important steps to buying a house or condo https://t.co/s1gYfBO4lU via @bokauffmann

MortgageCapital

6 important steps to buying a house or condo https://t.co/gi4iH7Bjhb via @bokauffmann

NJRealEstateAgt

RT @markbrian: 6 important steps to buying a house or condo https://t.co/lKYCIQSALc via @bokauffmann

George_Jester

RT @markbrian: 6 important steps to buying a house or condo https://t.co/lKYCIQSALc via @bokauffmann

markbrian

6 important steps to buying a house or condo https://t.co/lKYCIQSALc via @bokauffmann

StellaSamson

6 important steps to buying a house or condo https://t.co/rYWO8CbhQm via @bokauffmann

winnipeg_rt

RT @bokauffmann: #Winnipeg realestate 6 important steps to buying a house or condo https://t.co/1N1PCXgPna

bokauffmann

#Winnipeg realestate 6 important steps to buying a house or condo https://t.co/1N1PCXgPna

whinbest

6 important steps to buying a house or condo https://t.co/qXqmIR0DMP via @bokauffmann

RachelLaMar_JD

6 important steps to buying a house or condo https://t.co/HgJEqI4Qi9 via @bokauffmann

EmmaIndy

6 important steps to buying a house or condo https://t.co/EWle9zr8JS via @bokauffmann