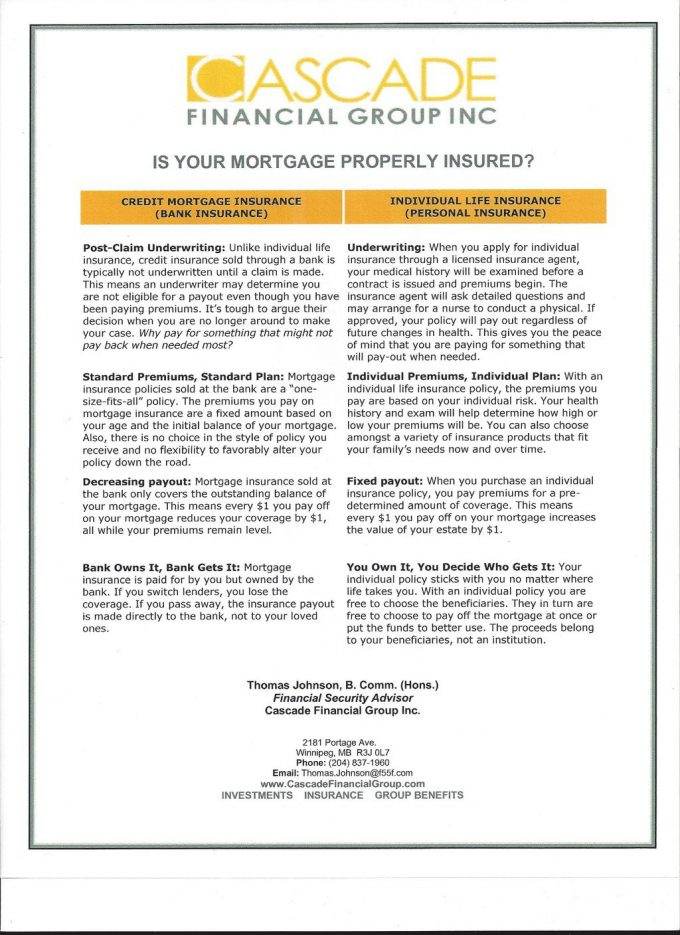

Lets say you bought a new house or condo, and you are considering mortgage insurance. Since mortgage insurance really is a form of life insurance, they're both the same. Potatoe, Potaahto, right? Not so fast…..lets look at some key differences.

Mortgage Insurance vs. Life Insurance

Life Insurance means YOU are the beneficiary

In Life Insurance, YOU are the beneficiary, as opposed to mortgage insurance where the bank is automatically named as the beneficiary. This is important, because it means that YOU decide how the insurance payout is used….as opposed to the payout only going against the mortgage balance.

The Payout amount remains the same

With mortgage insurance, only the remaining balance is paid off in case of your demise. So as you start to pay off your mortgage over the years, the benefit of your mortgage insurance actually decreases over time. With Life Insurance, the payout remains the same.

Guaranteed Payout

With Life Insurance, underwriting occurs at inception of policy as opposed to waiting until something happens to find out whether you qualify for the coverage. The added benefit of this is that the premiums are based on you and your current health. Discounts for non-smokers and age and sex apply in the Life Insurance option.

This last part is actually very important. A good friend of mine just learned the hard way: His mom had passed away and after about 18 months, the bank still had not agreed to pay off the mortgage insurance, fighting the family every step of the way. As my friend put it: “I'll never get mortgage insurance again. Bo, the agreement is 12-pages long, and 11-1/2 of those pages are designed to get the bank out of paying the benefits”….

Probably the biggest factor IN FAVOR of getting mortgage insurance is the simplicity of signing a document at the same time as signing the mortgage application. Simple,…easy…..done! As my friend put it...just pray you never need it!

Here is a summary of the differences:

If you're thinking of buying your first (or next) house or condo, check out these 7 biggest mistakes made by home buyers.

And beware of the Closing Costs when buying a home in Winnipeg.

About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

Emmy

“If you switch lenders, you lose the coverage”. That right there is enough for me to say that I don’t like mortgage insurance an see that it can make you feel locked into a lender that may not be operating in your best interest. It’s bad to feel like a prisoner in your own home. This mortgage insurance terms should seriously be re-constructed for better benefits to homebuyers.

Angelo

Well I don’t like the fact that in mortgage insurance only the remaining balance is payable upon my demise. This sounds super risky and could leave very little for my family.

Mariano Oleson

Well anything where the bank or the government is automatically named the beneficiary can’t be good. Thanks for this important information!

Vivien Coder

Yeah amen to that! I don’t want the bank to be any beneficiary on my policies!

Everheart

I’ve never heard this comparison broken down before in my life. Many times we just sign up (or get signed up) for things we don’t even fully understand. This for breaking this down in an easy to understand way.

Ria A.

Hmmm so the benefit of mortgage insurance actually decreases over time. This hardly seems worth it.

Bo Kauffmann

Correct….thats why life insurance may be the better option.

Dawn

I would prefer life insurance since I make the decisions about the beneficiary and do not have to worry about the bank keeping it from my family. The loss of a family member is difficult enough without added stress.

Bo Kauffmann

Exactly…. great comment and you are absolutely correct.

Amber

I was never aware that there was a such thing as mortgage insurance. This article was very informative, and based on what I have read I believe life insurance would be a much better idea.

nhic eguia

Very factual. I am not really aware about insurances before i have read this article.

Tamisha

Great video, Thanks for educating me on mortgage insurance vs life insurance. I will watch the vid a couple more times later to let the concept fully soak in.

@BlueFernRE

Mortgage Insurance or Life Insurance: Home buyers choices via @bokauffmann https://t.co/bAcNDUQG

@DrNotley

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/iq9NYjA4 via @bokauffmann

@markbrian

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/hoegSdKP via @bokauffmann

@cletch

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/mrQd8hjC via @bokauffmann

@canadaconnect

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/hMS2vw44 via @bokauffmann

@RachelLaMar_JD

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/1O37JAvf via @bokauffmann

@reluctantreagt

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/PjI3LC7R via @bokauffmann

@KenDavidsonCA

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/2vJSg2hI via @bokauffmann

@bokauffmann

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/xLElXVkn

@GaModernMom

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/gNPWozdX via @bokauffmann

@cendrinemedia

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/AN4G7Tue via @bokauffmann

@greeninvesting7

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/G9UURVms via @bokauffmann

@bokauffmann

Buying a new home or refinancing? Check out the differences between mortgage insurance and life insurance…: https://t.co/pTv06qwT

@HomeBuyerAgents

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/DmhK9kmK via @bokauffmann

@LoansCanada

Mortgage Insurance or Life Insurance: Home buyers choices https://t.co/ialQBKfw via @bokauffmann