What’s better, rent or buy your own home?

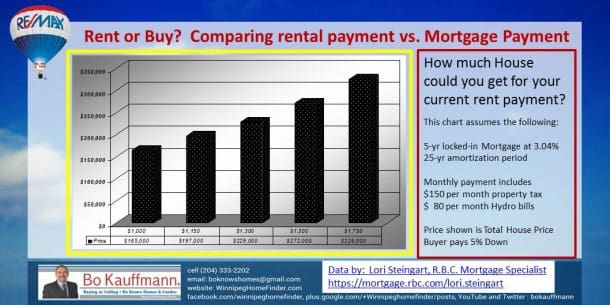

If you're currently renting a place, and thinking of buying a house or condo, here is a chart that might interest you.

Owning a home is a personal choice, and more than simply a financial decision. Other factors come to play, such as lifestyle, job security, etc .

How to read this Chart:

Along the bottom you will find monthly rental payments, ranging from $1,000 to $1,750 per month. The corresponding home price, ranging from $165,000 to $326,000 assume a mortgage rate of 3.04% over 25 yrs, which is the current available rate, for a 5-yr fixed with the Royal Bank of Canada.

This rate also assumes a monthly property tax of $150 per month, and a heating bill of $80 per month.

(Unfortunately this needs to be said, because the last time we showed a chart like this, some knuckle-heads took offence): This chart is simply for comparison and informational purposes. DON'T go buy a house based on this chart. Speak to a financial adviser or mortgage professional first. This chart is merely an aide to help you decide whether its better to rent or buy.

Interest rates are very low, and now is a great time to buy your first home. Contact me for a free, 45-minute consultation.

Thank you to Lori Steingart, RBC Mortgage Specialist, for providing the data in this chart.

Mortgages push household debt to new levels?

We just need to be a little more conservative and as brokers focus on more than just getting a client approved for what they qualify for. The latest bank data shows that total Canadian outstanding household credit rose to $1.869 trillion in August, up an annualized pace of 5.9% from July. Compared to the previous year, household debts were up 5% – the highest year-over-year increase since October 2012. Residential mortgage debt shot up 7.5% annualized in August, raising the three-month rate to 7%.

More info via Winnipeg's Real Estate Blog

Rent or Buy? Millennials better off buying a home than renting

Katherine Feser / Houston Chronicle photo Houston topped a list of cities where buying a home beats renting for millennials, according to a report by real estate listing firm Trulia. Trulias Rent vs. Buy report found that buying a house is 23 percent cheaper than renting nationwide for young households. Its an even better deal in Houston, where its 46 percent cheaper to buy than rent.

Katherine Feser / Houston Chronicle photo Houston topped a list of cities where buying a home beats renting for millennials, according to a report by real estate listing firm Trulia. Trulias Rent vs. Buy report found that buying a house is 23 percent cheaper than renting nationwide for young households. Its an even better deal in Houston, where its 46 percent cheaper to buy than rent.

More info via Winnipeg's Real Estate Blog

About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

Isabel

Renting or buying depends on your situation. If you are going to stay longer in one place, then you are better off buying a house than renting. For instance, when we knew we were going to stay for 3 years in Brussels, we just rented a house. At 1,600 euros a month, we threw away 57,600 euros for 3 years in rent money. But, it was the lesser evil because we did not want to buy a house costing 800,000 euros. Besides, we have already a house so why buy another in another country?

Karole

I’m done renting Im going to buy a home. I so tired of making my landlord rich!

Mariano Oleson

Glad to hear that interest rates are low now. How long do you think it will stay that way?

Tammi V.

well I click on the quiz like but it says This promotion has expired. But this article is helping me understand some of the pros & cons of renting vs buying. Thanks for this.

Bo Kauffmann

Thanks, Tammi. You were correct, that quiz had expired… thanks for letting me know. Glad you liked the rest, please come back anytime

Otha

I feel that renting is better for me at this time. It’s just me right now and I just do want the responsibility o owning a home.

Debby

I say it’s always best to own rather than buy any day. That’s just my opinion. Even if I don’t live in the house as long as originally planned, I can always sell the property or rent it out (well that is if my mortgage contract allows me to sub-lease/rent it out to others).

Bo Kauffmann

Yes, good point about the mortgage contract. Plus, owning property comes with all kinds of added benefits, including better credit history, provided you pay your mortgage on time…

Amber

It’s sad that in this day and age it has become necessary to post disclaimers such as that, because people are offended by everything. That chart, along with the quiz, seem to be very helpful tools in considering home buying options.

Bo Kauffmann

Thank you, Amber. And yes, I agree that it’s sad we have to pos disclaimers or special notes….

Dawn

I agree that owning a home is a personal choice, but a lot of people are taught growing up that if you don’t own then you aren’t successful. I have found as more of an adult, that this is just not true. Like you said, there are other factors to consider when making this decision, and it is best to seek the advice of a financial adviser before hand.

nhic eguia

For me, it is wiser to buy. Rentals make you invest on something you cannot own.

Doug

I was originally thinking about just renting…but after reading your article I think my mind has shifted toward buying and home ownership. Thanks for enlightening me!

Bo Kauffmann

Thank you for the comment, Doug. There is actually a whole range of benefits that come with home ownership that most people dont even realize….. good luck in your quest..

couvre-lit

Great things you’ve always shared with us. Just keep writing this kind of posts.The time which was wasted in traveling for tuition now it can be used for studies.Thanks

Leymaan J Abdalla

How can I found this. Huse

Winnipeg Home Finder - Bo Kauffmann

That house is just a photograph… Not for sale