Prospective home owners sometimes use the subject of condo fees to justify their preference of a house over a condo. The argument is: “If I buy a house, I can save the condo fees.” This reasoning is not entirely accurate, since it assumes that house-ownership is completely without cost.

Water, Home Insurance, and Heating Costs

- Water: Virtually all condo fees already include water and hot water.

- Home insurance: Property is also going to be substantially more in a house, since the condo building is already insured, and the condo-buyer only has to purchase condo insurance.

- Heating costs for an apartment or townhouse style unit are also going to be substantially less than the heating costs for a stand-alone house in the $200K range.

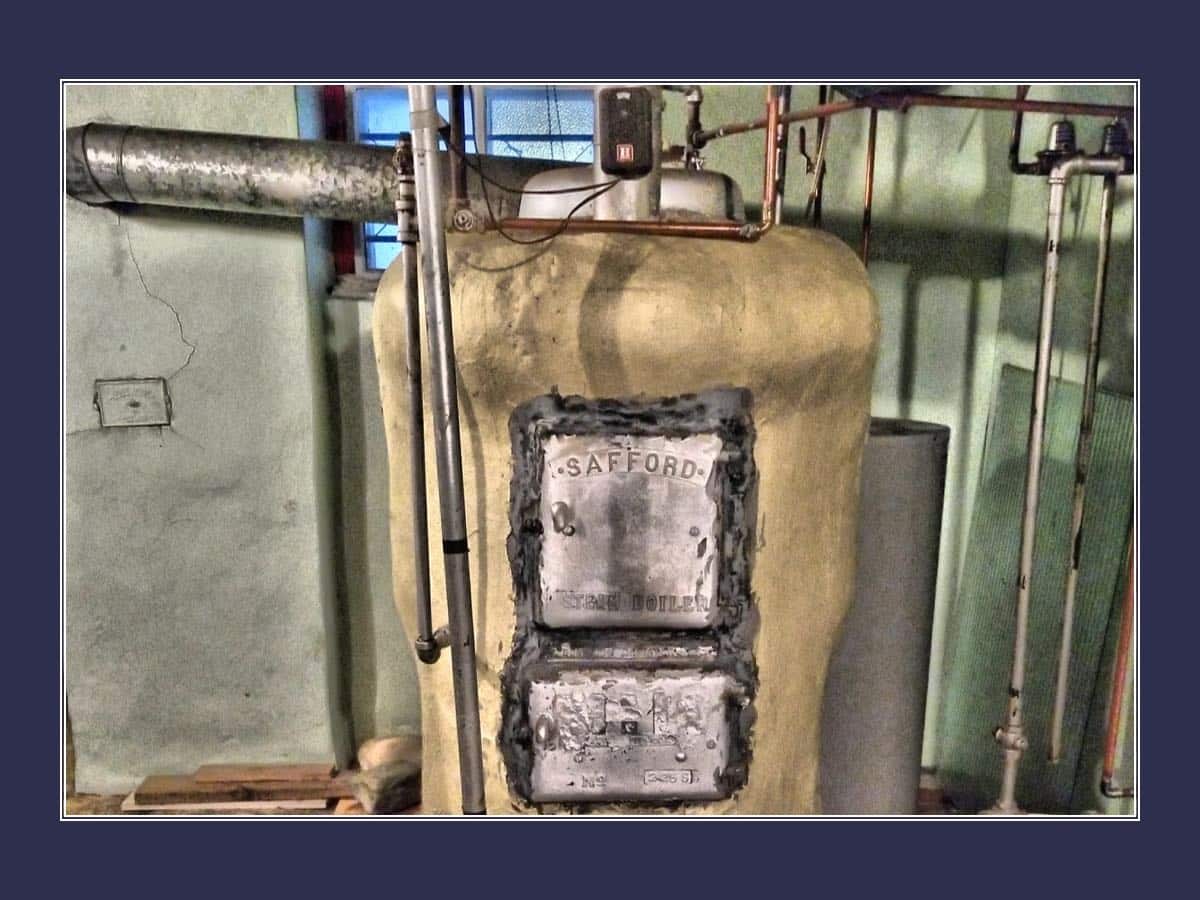

(I point out the price range, since MOST 200K houses will likely have either old furnaces, old windows, poor insulation, etc.)

Emergency Fund

Home owners (especially buyers of older buildings) are well advised to start an emergency fund for things that go wrong. For example, a new roof ($5000), new furnace ($4000), hot-water tank ($800), windows and doors ($15,000) can put a real dent into your savings. So putting aside a small amount each month, the house-owner could save enough money to pay for those things. All the while, the condo-fees already include this savings fund: its called the Condo Reserve Fund.

So lets take a look at the various savings in the chart below.

In the first column, we have the costs of house-ownership. The middle column shows that some of those items are already included, while the rest are substantially lower. The column on the right hand side shows the actual savings enjoyed by the Condo–Owner.

$215 per month LESS for the Condo

So in this example, the operating costs of a condo are actually about $215 per month LESS than the house, if you include the ’emergency fund’ savings plan for the house. So now, take the $215 off the condo fee of $275, and the actual additional costs (over and above a house-ownership) are only $60 per month. For that money, the condo owner gets professional management, landscaping and snow-clearing, and often the use of amenities such as workout room, swimming pool, etc.

It’s about life-style

Condo ownership is about the life-style. If you travel a lot, or are too busy for yard work, or any number of other reasons, then condo-ownership may be for you. It should be pointed out that, even in a condo, it’s prudent to have some extra money set aside, in case the Reserve Fund is not large enough to tackle any major project or renovation. When that happens, the condo owner will face a ‘Special Assessment‘, a sudden bill he will have to pay. But there again, thats really not much different from having to buy a new furnace or other major unexpected repair.

Condo Fees vs. Housing Expenses

F.A.Q. about Condo Fees

Can Condo Fees go up?

Since condominium fees usually cover services and fees which normally increase year over year, YES, condo owners should expect the fees to go up at least at the rate of inflation. As landscapers, utility companies and management companies increase their fees, your condo fee must keep pace.

What do Condo Fees include?

It really depends on the type of condo you own. In most cases, condominium fees will include management, landscaping, water, heat for the building (if it’s an apartment style condo) and contributions to a reserve fund.

How are Condo Fees calculated?

Once a year, a budget is created by the Condominium Board of Directors. They look at the yearly costs and expenses, project what those costs might be for the coming year, and add them all up. Each owner is then responsible for paying their percentage share of the total bill. This is why it’s important to know your ownership percentage, as your costs are directly tied to this number.

When are Condo Fees due?

In nearly all cases, the payment of these fees are due monthly, whether it’s on the first, 15th or last of any given month.

About the Publisher

About the Publisher

Bo Kauffmann is a residential real estate agent with over 18 yrs experience in helping buyers and sellers achieve their goals. Inducted into the REMAX Hall of Fame in 2010 and receiving the REMAX Lifetime Achievement Award in 2019, Bo has sold over 500 houses and condos in the Greater Winnipeg market. He is an accredited buyer representative (A.B.R.) and a Luxury Home Marketing Specialist.

Bo provides exceptional service to First-Time Home-Buyers, Seniors looking to downsize and Home Sellers of all ages.

He can be reached easily By E-Mail or call/text him Call/Text Here

Never miss an episode of our real estate podcast. Install our FREE Podcast App available on iOS and Android. For your Apple Devices, click here to install our iOS App. For your Android Devices, click here to install our Android App. Check my videos on Youtube

Ernie Parnell

Thanks for helping me!! I was confused about condo fees and it’s expenses so I was finding blogs for this and I got this article. All condo fees already include water and hot water this is also a new thing that I got to know.

Joe Boylan

Nice Job and helpful information. Homebuyers tend to lose sight of the big picture, this is exactly the type of info they need to keep costs in perspective!

Bo Kauffmann

Condo fees sometimes get a bad rap…..

Ronald Cabales

Margaret Tayco-Cabales

Lily

You didn’t mention the property tax.

Bo Kauffmann

Thank you Lily. In Winnipeg, the property tax rate for houses is the same as for condos, so equally valued houses and condos, in the same or similar neighbourhoods, would incur the same taxes.

Anonymous

How about the property tax?

Bo Kauffmann

Thank you for noticing. The reason I did not mention the tax is simply because the tax rate for houses is identical to the tax rate for condos, so there is no difference between equally valued properties.